It’s a frustrating scenario, isn’t it? You find yourself in a situation where you don’t have funds to cover a payment or worse, you have the money in your bank account but simply forget to make the payment altogether. If you’ve experienced this, you’re not alone. Trust me, I’ve been there more times than I’d like to admit. The struggle is real, folks. But fear not, because there’s an easy way for you to turn this chaotic bill juggling act into a well-orchestrated symphony: the Printable Monthly Bill Organizer.

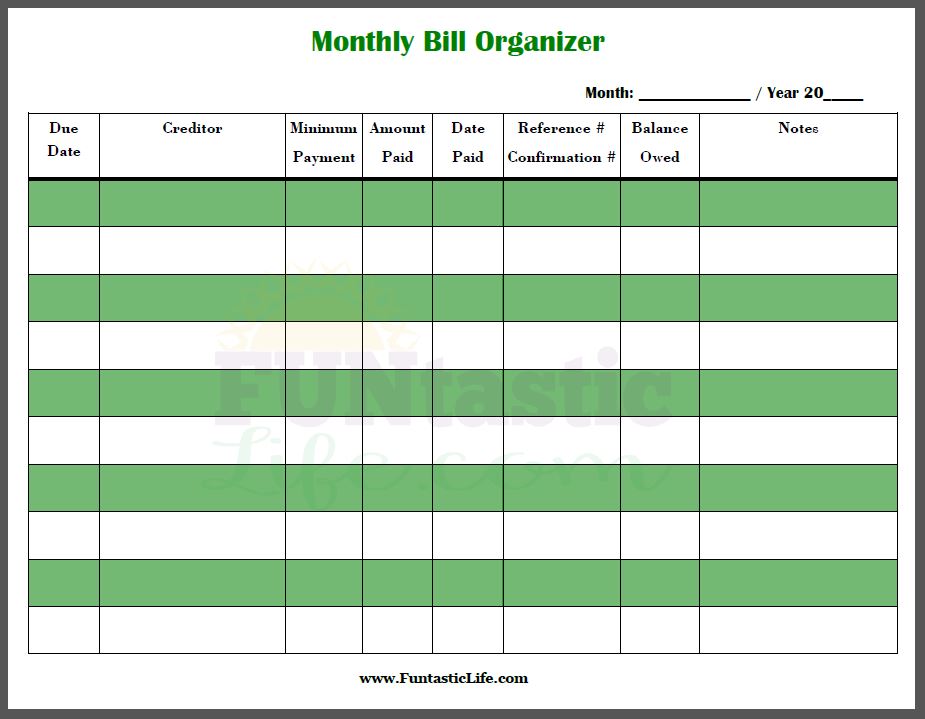

Let’s face it, staying on top of bills isn’t just about avoiding late fees; it’s about safeguarding your credit score and financial stability. That’s why I’ve crafted this lifesaver – a FREE Printable Monthly Bill Organizer designed to keep your financial ship sailing smoothly. With this tool, you can effortlessly track due dates, amounts owed, payment methods, and any noteworthy details for each account.

**Simply click on the image, so that you can download the printable file or print out your copy of this FREE Printable Monthly Bill Organizer

Now, let’s delve a little deeper into how this monthly bill tracker can revolutionize your bill-paying game. Picture this: instead of scrambling to remember due dates or nervously checking your bank balance, you have a meticulously organized chart at your fingertips. I recommend listing your bills in order of their due dates initially to ensure timely payments. However, if you’re just starting out, jot down your monthly bills and necessary information (due date, creditor, amount due/minimum payment, amount paid, date paid, reference number/confirmation number balanced owed) as the bills arrive. Once you’ve compiled your list, you can refine the order to suit your preferences in the following months.

But wait, there’s more! Let’s explore some additional benefits and practical tips for maximizing the effectiveness of this free printable bill tracker.

- Financial Peace of Mind: Imagine the relief of knowing exactly when each bill is due and having a clear overview of your financial obligations. Whether it is a car payment, your car insurance payment, a credit card payment or any other bill, with your monthly bill payment log in hand, you can bid farewell to those nagging worries about missed payments or overlooked bills.

- Budgeting Made Easy: Beyond keeping track of your monthly bills, your organizer serves as a valuable budgeting tool. By recording the amounts owed and paid for each bill along with keeping track of the amount you earn in a pay period, you will gain insights into your spending patterns in a single month and then in an entire year and you’ll be able to adjust your budget accordingly.

- Setting Reminders: In addition to tracking due dates on paper, consider setting digital reminders on your phone or computer. This extra layer of accountability ensures that you never miss a payment, even during hectic times (and we all know how hectic life can be).

- Emergency Fund Allocation: Life is unpredictable, and unexpected expenses can arise at any moment. Using this bill payment tracker is also a great way to allocate funds for an emergency savings account, providing a financial safety net for unforeseen circumstances. You may not start off with much money, but it won’t stay that way.

- Celebrate Milestones: As you diligently keep track of bills and make timely payments, don’t forget to celebrate your achievements along the way. Whether it’s reaching a savings goal or paying off a debt, acknowledging your progress boosts morale and motivates continued financial discipline.

- Review and Reflect: For best results, take a moment to review your bill calendar at the end of each month. Identify areas for improvement, such as reducing unnecessary expenses or renegotiating bills with service providers. Reflecting on your financial habits empowers you to make informed decisions and strive for greater financial wellness.

Remember, Rome wasn’t built in a day, and neither is financial stability so that you are able to achieve your financial goals. Consistency and discipline are key ingredients in mastering your finances. So, keep track of your bills and embrace your Monthly Bill Organizer as a valuable ally on your journey toward financial empowerment. With dedication and the right tools at your disposal, you’ll conquer your bills with confidence and pave the way for a brighter financial future.

The good news is that little by little we will help you to achieve your financial goals. That being said, you should also check out these FREE printables / resources as they are powerful tools:

- FREE Printable Annual Bill Organizer

- 52 Week Money Challenge and Reverse 52 Week Money Challenge

- FREE Printable Monthly Budget Sheet

Given their simple design, these printable pdf files are easy to use and would fit perfectly into a budget binder.

Pin for later…

Love these! Thanks so much!

Yay! More to come so keep checking back 🙂

This is perfect! Thanks!!

Finally I had tools to use to my bills need to paid on time. Its many printable tools but is one is perfect. I will be not late to my payments all my bills. Finally I had freedom from past due…

thank you for sharing this FREE Printable Monthly Bill Organizer. Its proven to be an invaluable tool as I help my college aged daughter manage her finances more effectively

I am so happy to hear that! Thank you for taking the time to let me know 🙂

This is great! I need this for myself. But I am also working on teaching my son how to manage his money. This is perfect for me to teach him with. It’s always easier to teach him with visuals. Thank you so much!

This will be super helpful. Thank you. I hope that it helps me get more organized!

This is really a huge thing for me. I am so lost without it. It’s the only way that I can keep up with my bills. Thank yo so much for this tool.

So glad you found it helpful!

I love the printable monthly bill organizer. I have been using this for a year.

I love organization but need someone like you to make it possible.

:

ONE recommendation:

I WOULD LOVE ONE PAGE WITH 14 ROWS TO PAY ALL MY CREDITORS ON ONE PAGE

🙂 THANK YOU 🙂 🙂

I love the ideal. I am trying to save money and keeping up with my monthly bills is the key to success. I have some wrote on paper, but this is more practical .

Finally I found one that I can use and it’s free!!! You made me a very happy girl. Just what I needed. I’ve searched everywhere and trying to find one like the one you made is almost impossible to find. Thank you for sharing.